Uncovering 5 secrets for rapid client implementations and great customer experience in payments and corporate banking

At Payments Canada Summit in May 2019, we had the pleasure of inviting some world class experts in payments and corporate banking to join us on the stage for a panel discussion. In this panel discussion, the group uncovered some key secrets on how banks can help their clients to onboard to bank services. This post summarises the key findings – 5 secrets – from the panel, with direct links to highlights of the discussion.

The panel consisted of

- Kate Risch Choi, Senior Product Manager – ERP Integration/ISO 20022, Treasury & Payment Solutions from BMO Financial Group (BMO)

- Leisa Millier, VP Product, Global Transaction Banking from TD Securities

- Brenda Wagle, Senior Payments Analyst, API Network and Directory Services from Payments Canada

The entire video of the discussion is here.

#1 Client implementations are a major painpoint for financial institutions and corporate clients

When banks bring on new clients, or sell new products and services to its existing clients, it needs to run through a process called onboarding. This is normally a tedious and complex process where the bank must capture data relating to the new client (referred to as KYC or Know-Your-Customer) and must perform due diligence according to anti-money laundering regulations.

A year back, CGI released their Transaction Banking Survey for the year 2018. This research highlighted that the corporate customers of a commercial bank struggle most with onboarding, product implementation/delivery, testing of integration and data/file formats.

Once Know-Your-Customer (KYC) documentation process is completed, and a bank has reached an agreement to provide transaction banking services such as cash management to a corporate client, the current practice is to start what is called often “a client implementation project”. In client implementations, banks require the client to go through a rigorous testing process. This is not a straightforward process with most banks.

On our panel, Leisa Millier commented that initially, there is usually a 4-6 weeks wait period for the clients to get set up with connectivity to the bank’s normal test environment. Typically test windows are also assigned, and bank staff have to be scheduled to be available to support that client during their test window.

#2 Client implementation processes contain waiting times and waste

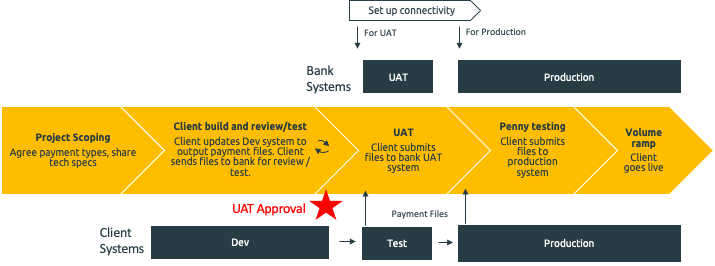

The current practice for implementation projects is roughly this:

- The work is kicked off by agreeing on the data formats in which information is exchanged between the parties. These might, or might not be standardised.

- Client ERP developers start to develop output according to the agreed specifications. Alternatively, the bank might customize its integration gateway so that it can receive the data in the format used by its client.

- Once this work is finished, the parties move to user acceptance testing (UAT), after which production processing is started with “penny testing”

Figure below illustrates the process.

Our panelists pointed out that during the development work and testing, the bank and its corporate client spend excessive amounts of time inspecting the file formats. The clients often send payment initiation files to the test environment that simply do not work. The bank will normally take 24 to 48 hours to report back on these test failures.

All this spent and elapsed time is a waste, is frustrating for the client, and can be eliminated.

#3 Build a new implementation process that supports fast turnarounds and then automate for a better client experience

The panelists gave some nuggets of information on how best-in-class banks have re-engineered their client implementation processes, to help clients get connected faster.

- If there is a bank just starting up with ISO 20022, it is good to onboard and implement first clients using manual processes. This is great for organisational learning.

- However, in order to serve a larger numbers of clients, some automation needs to be introduced in the client implementation process. This is especially important for large corporate clients, who have a mix of different banking products in use. When automating client implementations, the first step is to offer test environments and sandboxes that are easy and fast for clients to access.

- Start automating internal process first, then get clients involved. For example, offer a test environment or a sandbox to bank client implementation managers first, then once the team is ready you can get customers onboard.

- Basic large corporate client needs in client implementation are

- to be able to get access to examples and documentation.

- to be able to validate payment files.

- to find common errors quickly.

- to be able to simulate the different types of bank responses and statements (ISO 20022, US NACHA, CPA, SWIFT).

- to be able to perform regression testing.

#4 Standardised data formats and migrations to standards

In the panel, it was highlighted that recommending and encouraging clients to use standardised data formats instead of customised data formats speeds up client implementation. In addition, the customer experience will be better as a test environment can be opened up immediately, and logins to clients can be handled on day 1 of client implementation. It is important to point out that this approach reduces maintenance efforts on legacy systems as it reduces client-specific customisations in them.

When speaking about file formats in payments, treasury and cash management, there is one standard above all else: ISO 20022. Andrew Smith of UK’s challenger clearing bank ClearBank writes about using ISO 20022 in his blog post and essentially covers all the reasons why using ISO 20022 in data integration between parties in banking makes sense.

- It defines the financial products in payments

- It defines the essential business processes for payments worldwide

- It defines the essential data banks need to hold related to payments and accounts

As ISO 20022 is being globally used already in many places, with the above-mentioned benefits, it is pretty clear that it carries immense value.

However, it is often assumed that moving to global standards such as ISO 20022 is a panacea and banks and clients no longer have to worry about things like mapping between formats. That’s not the case. Many payment schemes still have not migrated to ISO 20022 and it can make sense for a bank to return the response files from the payment schemes in the format supported by the schemes : local standard formats or SWIFT MT. For a fast client onboarding experience, the bank needs to help clients that originate payments as ISO 20022 files to understand the mapping from the ISO 20022 files to these local and MT formats in the response files.

Here’s what the Kate Risch-Choi commented on standardisation:

#5 Real-time Payments and APIs are here already

It’s a pretty solid prediction to say that banks will start to use APIs in the future with their corporate clients in payments, treasury and cash management too. APIs in this area will enable

- initiation of instant/real-time payments by corporates

- real-time/just-in-time forecasts and reporting for cash management and liquidityAPIs will become a new “corporate integration mechanism”. Banks will build both standard and custom APIs for corporate customers.

Best-in class banks are offering developer portals test sandboxes for these kind of APIs.

There was a question from the floor on this topic in the panel, and the consensus is that real-time, whilst might not be offered yet by banks over APIs, will arrive – but batch processing will remain on certain payment types.

Now that you know the secrets, can you convince your executives to invest in a better customer experience?

In this age of digital banking, great customer experience is not only about strong relationships and personalised touchpoints. The business processes between the bank and the client need to be efficient – information must be passed automatically from one side to the other. Automation needs to be used in sensible ways to eliminate frustrating delays and wasteful use of bank and client resources. But there are also other things to consider:

- the right payment data formats for your clients need to be supported,

- standardisation can be a great help, and

- the need for more automated client implementation processes will only grow as we see real time payments being adopted in the market.

Ultimately, the implementation process for new clients with the right tooling enabled a bank to go from roughly 7 week client implementation project to 20 minutes. This is the hard fact one can use to justify the business case for investing in improvements, but the customer experience factors should not be ignored.

About XMLdation

XMLdation is a world leader in financial messaging. Our solutions are designed for banks and clearers.

Our solutions Request a demo today Subscribe to our newsletter