ISO 20022 Migration Journey

A Payments GPS – Here Comes ISO 20022

The set of ISO message formats know as “20022” have been around for a long time now. In fact, many of us will recall the decision to require use of ISO 20022 for Euro payments in the Single European Payment Area (SEPA). SEPA was introduced for credit transfers in 2008, direct debits in 2009, and instant credit transfers in 2017. Banks and fintechs working in Europe know ISO 20022 pretty well – for SEPA.

Accelerating global adoption

While the experience with SEPA is very helpful, adoption of ISO 20022 is accelerating globally, for a range of payment types and applications. And it’s not ‘just’ CBPR+ (SWIFT’s approach to ISO 20022 for correspondent banking). In a number of countries, RTGS systems, real-time payment infrastructures, and other domestic payment systems are moving. Here are some examples:

| Global | Europe | N.America | Asia-Pacific | MEA | Real-Time |

| CBPR + |

Target 2 EURO1 CHAPS P27 Norway/Sweden RTGS |

Lynx CHIPS Fedwire |

MEPS+ NPP HVCS CHATS ESAS |

SAMOS Buna |

FedNow RTR IPSL M-Pesa TIPS RT1 |

ISO 20022 – Migration? Journey?

In planning a journey, we need a sense of where we are, and where we want to go. We will need to identify waypoints or milestones, perhaps using tools like a map and a compass, so we can track progress. Ideally, we have a guide, someone who knows the way. And we should also think of tools and implements that will support our efforts, and help ensure success.

Knowns, Unknowns and …

In our experience, banks learn quite a lot about their current systems when embarking on any kind of change, including (or especially?) a format migration. This is completely normal, and with ISO 20022 migration, it’s no different.

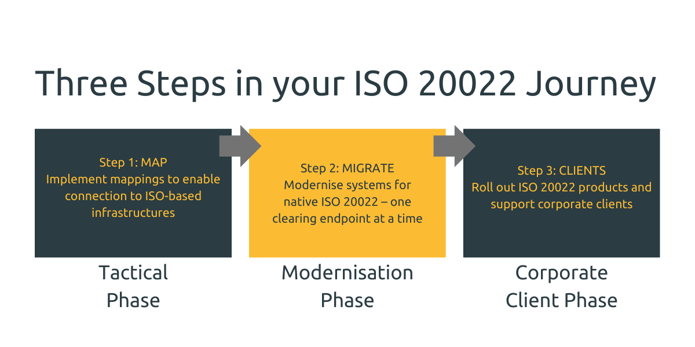

Here, we cannot talk much about a bank’s starting point, since all of them are different. We’ll therefore focus on the key waypoints in the journey, how to employ tools and methods to ensure success, and show what we see as the three steps that are specific to the migration journey:

- Step 1: Introduce Mappings – the Tactical Phase

- Step 2: Migrate to ISO one CSM or other system at a time

- Step 3: Get your corporate clients onto the new ISO based payment products

Phase 1 – MT / ISO 20022 mapping

First steps in the process centre on implementing a mapping process, for example with respect to SWIFT MT to ISO 20022 for CBPR+ (or perhaps TARGET2). Payment systems that don't (yet) support ISO 20022 will still need to connect to new, modernised ISO 20022-based clearing systems, or that will migrate. There may also be ancillary systems, such as AML or fraud systems, that you never expected to “speak” in ISO 20022.

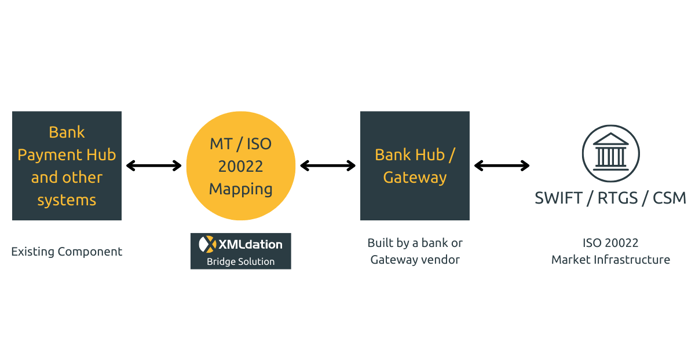

To meet this challenge, the first step is to implement mappings between your payment system and CSMs (or other payment gateways) and ancillary systems. The goal (waypoint) of this step is to connect the new mapping in an integration layer between the systems.

This step can be done on-premise, or as a cloud solution, as long as the bank is still able to reliably connect its payment hub and other core systems to the destination market infrastructure (or clearing system). The connection could be by means of a new hub/gateway that’s built by the bank, or provided by a gateway vendor.

A ”bridge solution” (in the middle of the illustration above) is a good way to configure mappings (including complex ones) based on industry libraries, and convert message to allow for reliable integration to the bank’s payments gateway, to ensure uninterrupted operations – combined with the ability to make adjustments (quickly, in many cases) in the mapping.

A ”bridge solution” (in the middle of the illustration above) is a good way to configure mappings (including complex ones) based on industry libraries, and convert message to allow for reliable integration to the bank’s payments gateway, to ensure uninterrupted operations – combined with the ability to make adjustments (quickly, in many cases) in the mapping.

For many banks, geography is a consideration, and mapping will need to be performed for a varied set of payment formats with respect to linkages with different payment infrastructures. The bridge solution allows for the flexibility to allow all entities to look at (for example) SWIFT CBPR+, but also help entities in individual markets to move at their own pace.

Phase 2 – Modernise Systems for Native ISO 20022

Even if some migration timelines have been shifting, it’s unavoidable that over time, bank systems will need to support “native” ISO 20022. This is the whole purpose of the migration – it’s the journey’s destination. Making the necessary changes is a challenge that encompasses any number of core systems, both individually and collectively as they interact with the payments systems. This step is where the traveller will need to rely on the equivalent of a good map, and a compass. How to ensure that you’re on track?

Environment for End-to-End Testing

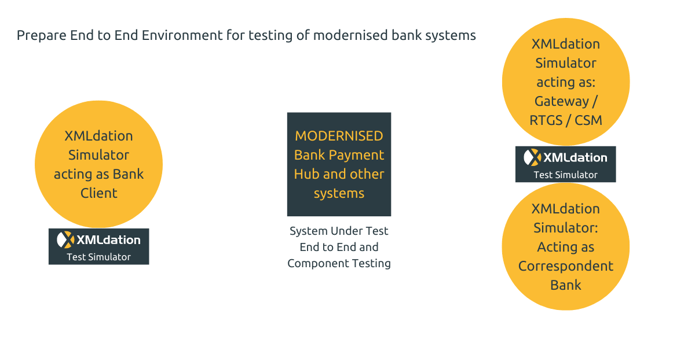

Long ago, it was hard to imagine a device that shows in real time if your journey is on track – now we have GPS. A payment flow simulator can act as a kind of payments GPS to help keep your ISO 20022 migration journey on track.

Long ago, it was hard to imagine a device that shows in real time if your journey is on track – now we have GPS. A payment flow simulator can act as a kind of payments GPS to help keep your ISO 20022 migration journey on track.

To test and prove that bank systems can support native ISO 20022, the simulator replicates messages and responses with a variety of potential participants and stakeholders:

- A bank client – which could also be a bank participating in a clearing system

- A correspondent bank or indirect participant, or

- A gateway to an RTGS or other clearing and settlement mechanism (CSM)

The simulator validates messages and accurately shows responses or ‘round trips’ (including happy/unhappy cases) among the participants in a system, including internal message flows, and generates realistic test messages. The simulator is a key part of a realistic test framework, and can significantly reduce timelines, so you can modernise systems faster and with confidence that your journey is on track.

In this phase, it is important to gain a deep, but pragmatic understanding of the standard and the mappings. Using the simulator speeds up this process, and the single platform can be employed to replicate a production workflow, which supports the automation of the production conversions required.

Here, it is important to note that payment system modernisation, and the rollout of ISO 20022 across systems, is a long journey. Over time, there will be scheduled updates to your systems – the journey will have many waypoints, creating the need to test (and re-test) regularly. A simulator, as part of a robust test programme, will make the journey smoother, and ensure there is no breakage as you roll out updates in a multi-year programme.

Phase 3 – Migrate Corporate Clients

Corporate clients are especially impacted by the transition to ISO 20022. Even smaller companies buy and sell internationally, and have increasingly employed accounting, ERP and treasury systems to support their business needs and drive efficiency. They face many of the same challenges that banks do, which also puts banks in a unique position to help their clients.

As part of the migration phase, clients will need to hear the benefits of ISO 20022 – beginning with an understanding of how the bank’s modernised systems support new payment products, like real-time payments. Critically, ISO 20022 based payments will carry more and better-quality data, which will help corporate treasuries to manage cash and working capital more effectively, for example facilitating the introduction of efficient payment hubs.

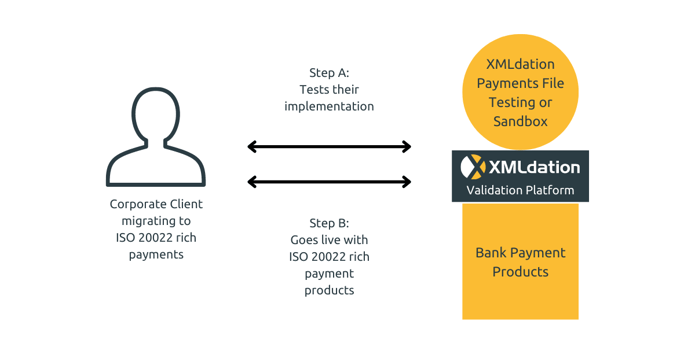

Banks that give their clients access to a payments GPS can provide them with a way to better understand both the challenges and the opportunities presented by ISO 20022, help guide their own journey, and enhance the client relationship.

A payments file testing platform, especially one that’s run in the cloud, gives your clients access to a secure and powerful method of validating ISO 20022 message formats, which helps better understanding of the relationship to legacy formats – and the transition.

A payments file testing platform, especially one that’s run in the cloud, gives your clients access to a secure and powerful method of validating ISO 20022 message formats, which helps better understanding of the relationship to legacy formats – and the transition.

The platform solution can also incorporate the simulator, configured to allow clients not only to validate and test messages they send to the bank, but also to test responses form the bank (a full ‘round trip’). The validator and simulator together offer your clients a huge advantage, especially if they are using ERP and other payments related systems.

Choose Your Navigational Help Wisely

What should a payments GPS platform look like?

It should be a platform that helps you and your clients navigate the migration to ISO 20022, supporting testing and conversion capabilities on the same platform.

Easy configuration

The platform can match the business logic of different formats, message flows and stakeholders – backed by an experienced, expert team. Some tasks can be done by clients, and we help get you started

Support for all payment formats

We support ISO 20022, SWIFT MT, and also ISO 8583 – as well as domestic and proprietary message formats. For APIs, we also handle PSD2 and other open finance API standards.

International payments experience

Experience with clients in many different markets has taught us a lot – which we can share with you! Our products are used in Europe, North America, Asia and Africa.

Born in the cloud

The multi-tenancy platform (common code base), ready to use in cloud – it can also be deployed on-premise (on request). The technology stack is modern robust, secure and scalable.

About XMLdation

XMLdation is a world leader in financial messaging. Our solutions are designed for banks and clearers.

Our solutions Request a demo today Subscribe to our newsletter