What Has ISO 20022 Ever Done For Me?

The transition to ISO 20022 will advance efforts to provide more and better transactional data, which is vital for the digital economy — bringing benefits to consumers, businesses, and regulators. Changing to ISO 20022 is needed to support digital transformation and automation, in financial services and beyond.

The international network of payment systems that serves individuals and companies is undergoing a necessary but challenging adjustment – adopting a new (-ish) set of electronic payment formats that will ultimately help improve financial services for all. Payment System Operators (PSO) and Banks alike will be making fundamental changes to their core payment and settlement systems, a daunting prospect that logically extends to all systems that their clients depend on.

At XMLdation we see the transition to ISO 20022 as part of the fundamental change needed to support the quality and quantity of data needed for a digital economy - with benefits to consumers, businesses, and regulators. A consistent, seamless and efficient digital payments infrastructure supports and even encourages the kind of transparency necessary for economic efficiency and security.

Modernizing payments infrastructures is also becoming a competitive issue, as new and innovative players enter the payments market.

In the late 1980’s the then-CEO of Citibank (and the first bank CEO to come from a career in banking operations) said “Money is information on the move”. What he meant can be explained twofold:

1) the exchange of value (especially money) is a key means by which counterparties communicate and maintain a commercial relationship, and

2) information about a payment is as important as the payment itself. If you’re buying a house or waiting for a shipping container to be released, you need to first know that the payment has occurred.

The banking industry, even in advanced economies, has been slow to introduce the kind of digital experience people have come to expect based on their experience with other services like retail and insurance. As part of a digital experience, both consumers and businesses are demanding more and better information about their finances, and this starts with payments, the circulatory system of every economy.

When we look at bank statements, for each transaction we see strings of numbers that are vital to the systems that process payments. But to consumers and business people, these strings of numbers are virtually meaningless. The really useful information (like invoice or order number, or the reason for the payment) that customers and their ERP/accounting systems, need to identify and reconcile the payment, is too often left out. Why? Because legacy payment message formats were designed in an age when computer processing was limited, and so was the space available in legacy message formats. It’s why we had two-digit years that led to the Y2K scare.

ISO 20022 provides the ‘space’ for both the vital processing-related bits, and the bits that interest customers. Not only that, but the new format allows other commercial data relating to a transaction to be included – information that goes beyond “just” the reconciliation of the payment itself. ISO 20022 can help transform payments systems into commercial (and regulatory) data superhighways.

ISO 20022, as an XML-based standard that is very flexible (unlike many of its predecessors) will help the financial industry realize the aim of providing better data and services, and supports building a true digital experience.

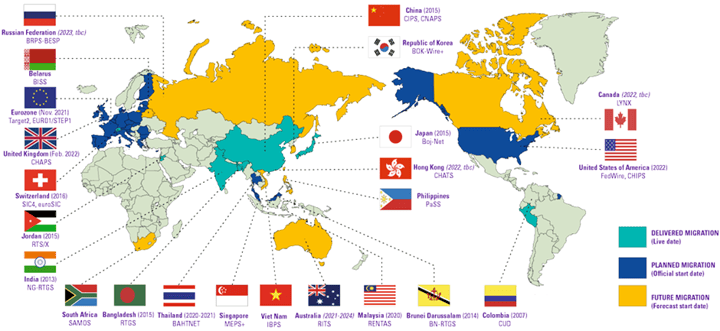

The European Central Bank, Bank of England, The Clearing House, Federal Reserve, and SWIFT are planning moves to ISO 20022, and other central banks and payment system operators are committed to renewal projects that will require migration to the standard. It thus seems clear that much of the world’s cross border payments will follow. ISO 20022 is also being adopted by many securities repositories and other clearing systems.

How to answer the question, “what is ISO 20022 doing for me?”

We need only look at how the financial industry meets customers’ needs, and how the transition to ISO 20022 paves the way for better data and a full digital experience.

About XMLdation

XMLdation is a world leader in financial messaging. Our solutions are designed for banks and clearers.

Our solutions Request a demo today Subscribe to our newsletter